Investments in Climate-Themed Funds: Focus on Power Generation

The necessary decarbonisation of the economy creates opportunities for investments in climate-themed funds, says René Nicolodi. The Head of Equity & Themes at the Asset Management of Zürcher Kantonalbank explains in the show "Geld" who the winners of the transformation could be.

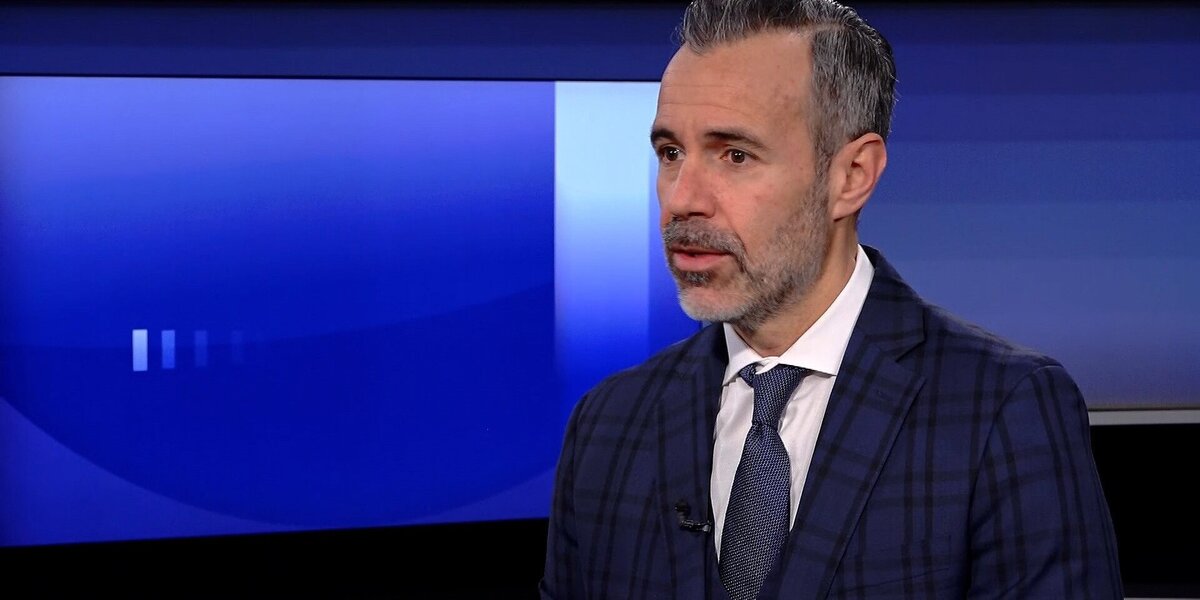

Interview with Dr René Nicolodi

Martin Spieler: What impact does climate change have on the global economy?

René Nicolodi: The high concentration of CO2 emissions is causing the Earth to warm increasingly. The International Energy Agency assumes that without strict countermeasures, global warming will increase by 2.4 degrees Celsius by the end of this century. Direct consequences of the temperature rise include extreme weather events, glacier retreat, hunger, and water crises that are worsening. Indirect consequences include increasing health risks, which in turn affect the economy. The economic costs of these damages and risks are estimated to be 38 trillion US dollars by 2050.

Climate change is a global challenge. What benefit does it bring to the climate if Swiss private investors invest in climate funds?

Climate protection requires a societal, but above all, a political framework. If this framework is in place, capital and financial markets can perform very important functions: On the one hand, by allocating capital to companies for the development and provision of solutions against climate change. On the other hand, this will lead to the rapid transformation towards decarbonisation that we need. This requires large investments.

What opportunities does the fight against greenhouse gas emissions and for decarbonisation offer from the perspective of investors?

They benefit from an investment theme that is likely to be structurally and long-term present and could offer very high growth opportunities. At the same time, the rapid decarbonisation that is necessary will create many winners – but also losers. So, it is a theme that investors want to reflect in their overall portfolio. This also from a risk perspective.

In which areas do the greatest investment opportunities for climate-relevant themed funds arise against this background?

From our perspective, the focus is on power generation through renewable energies and energy efficiency in general. This also includes the expansion of energy infrastructure and the electrification of the mobility sector – and generally the efficient use of resources.

How can private investors engage in the fight against climate change and generate returns at the same time?

Climate protection on the private side starts with each individual. There are behavioural components and measures that can be easily integrated into everyday life. On the investment side, investors can send a signal and contribute to the faster realisation of decarbonisation.

For whom is such a climate fund suitable, also from a risk perspective?

There is still an investment risk. Investors are operating in a specialised field and investing in companies that provide specific solutions. These tend to be small and mid-cap companies that also generally exhibit greater risks. Therefore, good diversification is very important. Furthermore, an active approach can be worthwhile, as the theme is very dynamic, competitive, and also influenced by political conditions.

This interview was first broadcast in slightly modified form on 4 April 2025 on the TV programme "Geld" on Tele 1, Tele M1 and TVO (Swiss German only).

Suitable funds

Suitable funds

Legal notices

Legal notices

This publication was prepared by Zürcher Kantonalbank and is intended for distribution in Switzerland. It is not intended for people in other countries.

The information contained in this document has been prepared by Zürcher Kantonalbank with customary diligence. However, no guarantee can be provided as to the accuracy and completeness of the information. The information contained in this publication is subject to change at any time. No liability is accepted for the consequences of investments based on this document.

This information is for advertising and information purposes only and does not constitute investment advice or an investment recommendation. This publication does not constitute a sales offer or an invitation or solicitation to subscribe to or to make an offer to buy any financial instruments, nor does it form the basis of any contract or obligation of any kind. The recipient is advised to review the information, possibly with the assistance of an advisor, to determine its compatibility with their personal circumstances as well as its legal, regulatory, tax, and other implications. The information contained in this publication may be adjusted at any time.

Unless otherwise stated, the information refers to Zürcher Kantonalbank's asset management under the Swisscanto brand, which primarily includes collective capital investments under Swiss, Luxembourg and Irish law (hereinafter referred to as "Swisscanto funds").

The investment opinions and assessments of securities and/or issuers contained in this document have not been prepared in accordance with the rules on the independence of financial analysts and therefore constitute marketing communications (and not independent financial analysis). In particular, the employees responsible for such opinions and assessments are not necessarily subject to restrictions on trading in the relevant securities and may in principle conduct their own transactions or transactions for Zürcher Kantonalbank in these securities.

The sole binding basis for the acquisition of Swisscanto Funds is the respective published documents (fund agreements, contractual conditions, prospectuses and key investor information, as well as annual reports). These can be obtained free of charge from products.swisscanto.com/ or in paper form from Swisscanto Fund Management Company Ltd., Bahnhofstrasse 9, CH-8001 Zurich, which is the representative for Luxembourg funds, and at all branch offices of Zürcher Kantonalbank, Zurich.

Carne Global Fund Managers (Schweiz) AG is the representative for funds domiciled in Ireland. Zürcher Kantonalbank is the paying agent for the Irish Swisscanto funds in Switzerland and Luxembourg funds.

It should be noted that any information about historical performance does not indicate current or future performance, and any performance data provided may not consider the commissions and costs incurred when issuing and redeeming fund units. Any estimates regarding future returns and risks contained in the document are for informational purposes only. Zürcher Kantonalbank does not provide any guarantee for this.

Every investment involves risks, especially with regard to fluctuations in value and return.

With regard to any information on sustainability, it should be noted that there is no generally accepted framework and no generally valid list of factors in Switzerland that need to be taken into account to ensure the sustainability of investments.

For Irish and Luxembourgish Swisscanto funds, information on sustainability-related aspects in accordance with the Disclosure Regulation (EU) 2019/2088 is available at products.swisscanto.com/ .

The products and services described in this publication are not available to US persons in accordance with the applicable regulations. This publication and the information contained in it must not be distributed and/or redistributed to, used or relied upon by, any person (whether individual or entity) who may be a US person under Regulation S of the US Securities Act of 1933. US persons include any US resident; any corporation, company, partnership or other entity organised under any law of the United States; and other categories set out in Regulation S. Status of the data (unless otherwise stated): 03.2025 © 2025 Zürcher Kantonalbank. All rights reserved.