Investing in Swiss stocks: What to consider at the kick-off of the dividend season

The dividend season is approaching in the Swiss stock market: The pharmaceutical company Novartis traditionally opens the series of payouts. We explain why dividend strategies seem attractive in the long term when investing in Swiss stocks and which aspects are essential for implementation.

Given the many uncertainties in geopolitics, volatile financial markets, and the low-interest environment, the upcoming dividend season gains special significance. Especially in Switzerland: Dividends are synonymous with an attractive and reliable source of income for many investors. Thanks to the strong innovation and good market position of local companies, an above-average dividend yield can be expected when investing in Swiss stocks compared to the most common international benchmark indices.

Specifically, according to our analysis, listed Swiss companies distributed around CHF 53 billion to their shareholders in 2024. Due to the positive earnings development in the past year, this amount is likely to be exceeded in 2025. With the recent decline in interest rates, the yield advantage of Swiss stock dividends over the yield of ten-year Swiss government bonds has expanded to around 2.5% (see chart below). This yield advantage could increase further in the coming months if the expected interest rate cuts by the Swiss National Bank materialize.

Dividends or buybacks: Different paths for Swiss stocks

Many listed Swiss companies have committed to a progressive dividend policy, meaning short-term earnings fluctuations are not directly reflected in dividend payouts. Such a dividend policy can also be seen as a long-term promise to investors in Swiss stocks and serves as a kind of commitment. Accordingly, this commitment is a strong quality signal, as only companies with a robust and future-oriented business model can ensure such payout behavior. Companies that have increased their dividend payouts every year for over 25 years are referred to as dividend aristocrats in technical jargon.

To meet the high expectations of investors in Swiss stocks regarding consistent dividend payouts, share buybacks have also become more established in the Swiss stock market (see box below). This tool of liquidity return gives management more freedom in capital allocation, as share buybacks are more optional in nature: Companies can adjust their buyback programs depending on their financial situation and market conditions. This allows management to use capital more efficiently and dynamically shape their financial strategy. The pace of share buybacks can also be accelerated or slowed down. Over the past ten years, investors in Swiss stocks have received an annual return of around 2% in the form of share buybacks.

Share Buybacks Are Becoming More Important

Share buybacks have gained in importance in recent years as they offer some advantages over dividend payments. As the name implies, Swiss companies buy back their own shares on the market and then cancel the securities. The reduction in the number of shares increases earnings per share. This concentration of earnings has a positive impact on the performance of Swiss equities. Since capital gains are tax-free in Switzerland, this option is a tax-efficient alternative to dividend payments, particularly for private individuals. In summary, share buybacks offer a versatile and flexible method of returning capital to investors in Swiss equities. However, buybacks should be used carefully and strategically.

Dividends as a powerful return lever when investing in Swiss Stocks

A progressive dividend policy is more than just a promise to shareholders. It also serves an important role in bridging the information asymmetry that often exists between company management and investors in Swiss stocks: Management typically has a clear knowledge advantage about the company and its operational development. Sustainable, increasing payouts can therefore signal externally that management views the future operational development positively. Furthermore, a generous payout policy supports efficient capital management and prevents investments in value-destroying projects, thus acting as a disciplinary measure for management.

Historically, dividends have proven to be a powerful return lever when investing in Swiss stocks. Reinvested dividends have contributed 50% of the long-term total return from an investment perspective. The remaining 50% comes from positive price performance, which is strongly correlated with the earnings growth of the respective companies.

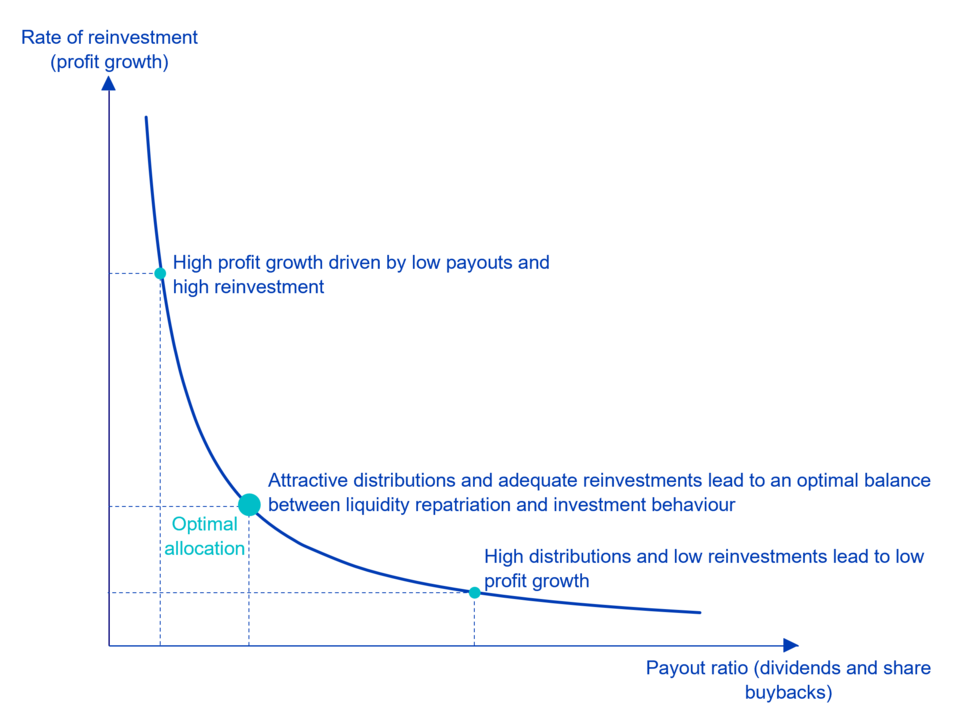

The optimal capital allocation of a company is thus expressed in the company making value-enhancing investments to stimulate future earnings growth while also distributing significant amounts of capital to shareholders. Due to this trade-off between reinvestment and payout ratios, it is crucial that a dividend strategy takes this balance into account. Therefore, an in-depth analysis of a company's capital allocation is essential for the long-term success of a dividend strategy.

Trade-Off Between Reinvestment and Payout

Diversification Should Not Be Forgotten When Investing in Swiss Stocks and Dividends

In addition to a thorough analysis of capital allocation, diversification across different sectors and business models is crucial when implementing a dividend strategy. This is no small criterion: Investors who focus solely on dividend yield when investing in Swiss stocks risk excessive dependence on a few sectors. Moreover, companies with high dividend yields are often in sectors facing structural headwinds. An example of this is the Swiss telecom sector, which ensures high payouts but offers few growth opportunities and is constantly under margin pressure. Therefore, it is important to leverage the diversification effect and assess stock positions in the portfolio context.

Conclusion: What Is Essential When Investing in Swiss Stocks and Dividend Strategies

- Dividend strategies gain increased attention when investing in Swiss stocks, especially in the context of falling interest rates.

- For the long-term success of a dividend strategy, a holistic and forward-looking approach to assessing a company's payout profile is preferred. Therefore, the dividend yield should not be the sole decision criterion.

- It is crucial to comprehensively analyze the business model, capital allocation, and financial metrics to implement them in a diversified portfolio.

Fund in the spotlight

Fund in the spotlight

Legal Information

Legal Information

Past performance is no indication of current or future performance, and the performance data do not take account of the commissions and costs incurred on the issue and redemption of units.

Notes on the chart: “BLOOMBERG®” and the Bloomberg indices listed herein (the “Indices”) are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the Indices (collectively, “Bloomberg”) and have been licensed for use for certain purposes by the distributor hereof (the “Licensee”). Bloomberg is not affiliated with Licensee, and Bloomberg does not approve, endorse, review, or recommend the financial products named herein (the “Products”). Bloomberg does not guarantee the timeliness, accuracy, or completeness of any data or information relating to the Products.

As of 01.06.24