Investment theme water: solutions to tackle PFAS are needed now

Reports of PFAS in meat, fish and human blood are also causing concern in Switzerland. Elsewhere, authorities and companies have already taken action to tackle the problem. And as it turns out, eliminating these persistent chemicals offers growth opportunities - which should interest investors.

PFAS are currently living up to their colloquial name of 'chemicals for eternity'. The poorly biodegradable and partly toxic per- and polyfluorinated alkyl substances (see box below) also continue to make headlines. After contaminated meat in the canton of St. Gallen and traces in fish in Basel hit the headlines in recent months, the magazine 'Saldo' (in German) recently reported on blood samples taken from children, among others. PFAS were reportedly found in all these samples - at levels that can cause illness.

It is unlikely that the chemicals will become any quieter in the future. The large number of substances (several thousand), their persistence and their widespread use in industry have meant that the chemicals are entering the environment through a variety of pathways. This is a major cause for concern. But there is still little talk of solutions. Meanwhile, specialised companies have already started to remove PFAS, taking a pioneering role that may be of interest to investors.

Both valued and feared

This is all the more true as the problem is global and growing in scale as new scientific evidence continues to emerge. For example, a meta-study published last April shows that the problem of PFAS contamination is much more widespread than previously thought. The study was based on more than 45,000 surface and groundwater samples from around the world.

What are PFAS?

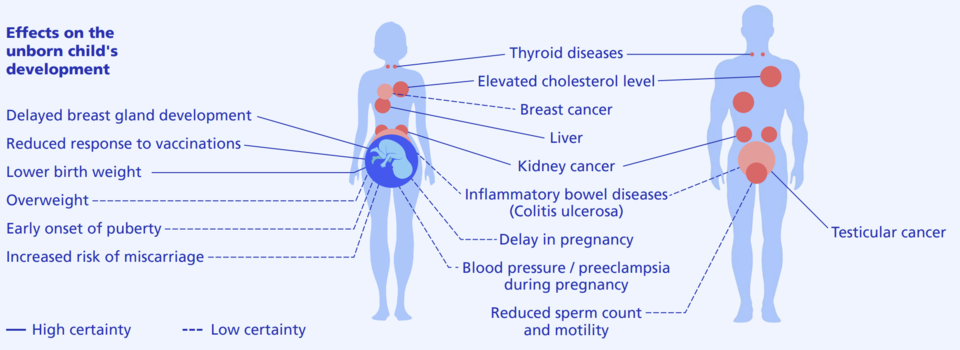

Coated pans, outdoor clothing, firefighting foam, even dental floss: PFAS are everywhere in our daily lives. They are valued for their ability to repel dirt, water and grease. However, according to the Federal Office for the Environment (in German), these highly stable synthetic substances - a group that includes around 15,000 chemicals - pose a risk to the environment and health. Because of their longevity, they accumulate in the body over time and can have serious effects.

Such findings are also raising eyebrows in the country and prompting authorities to take action. Since 2011, efforts have been made to regulate PFAS more strictly in order to counteract the harmful effects on humans (see table below) and the environment. The chemical perfluorooctane sulfonate (PFOS), which is suspected of causing heart disease and cancer, will be completely banned in Switzerland from the beginning of 2024. This followed a pilot study by the Federal Office of Public Health (FOPH) in 2023, which found traces of PFOS in every blood sample taken from people in Switzerland.

However, it turns out that other countries have been dealing with the issue for much longer and are therefore further advanced in solving the PFAS problem. Regulation by public authorities is proving to be an important structural driver in this context; the resulting pressure to clean up or remove contamination provides attractive opportunities for the private sector in a second step. The growing scale of the problem suggests that the future cost of properly disposing of contaminated materials, for example, could quickly run into the billions.

This, in turn, makes the issue attractive to investors with a long-term and sustainable perspective.

Effects of PFAS on the human body

The US is leading the way in finding solutions. This is hardly surprising, given the long history of the PFAS issue there. These persistent chemicals have been causing a stir in the US since the 1980s and were the subject of major lawsuits against industrial and chemical companies in the 1990s. This has led to some movement.

This year, for example, the Environmental Protection Agency (EPA) set new, relatively strict limits for PFAS in drinking water, which will be mandatory for US utilities from 2029. Meanwhile, the military is already moving to decontaminate its facilities. For example, some bases are considered to be heavily contaminated due to the use of firefighting foam containing PFAS; the US Department of Defence (DoD) has estimated the ongoing costs of analysing and decontaminating defence facilities at nearly $34.7 billion for the fiscal year 2024.

The DoD is one of Tetra Tech's most important clients. According to public statements, in 2024 Tetra Tech will generate around 90 per cent of its PFAS revenues from services provided to the DoD. However, management has said that in the near future, much of the growth could come from other sources - namely US municipalities that need to take action because of stricter limits. In the US, the water utility industry estimates that implementing the new EPA limits could cost at least $50 billion over the next 20 years.

A quarter of a century ahead

Tetra Tech, for example, stands to benefit. The company estimates that its revenues from PFAS testing and consulting could double to $60 million by 2025. This would still be a small contribution to total revenues. But one that suggests there is significant potential. More importantly, it would mean that the company has entered a potential growth area early, making it a first mover.

Another pioneer in the search for solutions to PFAS is the Japanese company Kuraray, which has more than 25 years of experience in the use of activated carbon filters. Activated carbon is one of the most thoroughly researched methods for removing such chemicals. It is highly porous and has a large surface area. The EPA specifically lists it as a method for dealing with PFAS in drinking water, along with ion exchange resins and reverse osmosis, which are also used in water treatment.

Expertise required

This is likely to play into the hands of the Japanese. According to Kuraray, the company expects activated carbon to be used in three out of four PFAS drinking water treatment applications in the US in the future. In addition, the company estimates that $1-2 billion worth of solutions will need to be installed annually by 2030 to comply with the new EPA regulations. For Kuraray, too, PFAS solutions are only part of its offering. As a result, they are not yet relevant to profitability and are unlikely to be priced into the market.

However, as more countries move from the awareness phase to the solution phase of the PFAS problem, the technologies of the pioneering companies could be applied more widely.

From an investor's perspective, picking first movers at the right time requires expertise and a willingness to take risks. Accordingly, actively managed diversified investment strategies can be used to invest in the potential of emerging industries. For example, for the Swisscanto (LU) Equity Fund Sustainable Water, the asset management team at Zürcher Kantonalbank focuses on several sub-areas within the sustainable investment theme of 'water': the PFAS issue falls into the areas of direct and indirect water protection.

Within the framework of the investment strategy, these segments are supplemented by the two areas of water technology and water supply. This is done in order to achieve an even greater diversification of opportunities and risks.

Investment theme «Water»: Insights

Legal Disclaimer Switzerland and international

Legal Disclaimer Switzerland and international

This document only serves advertising and information purposes, is for distribution in Switzerland only and is not directed at persons in whose nationality or place of residence prohibit access to such information under applicable law. Where not indicated otherwise, the information concerns the collective investment schemes under the law of Luxembourg managed by Swisscanto Asset Management International S.A. (hereinafter "Swisscanto Funds"). The products described are undertakings for collective investment in transferable securities (UCITS) within the meaning of EU Directive 2009/65/EC, which is governed by Luxembourg law and subject to the supervision of the Luxembourg supervisory authority (CSSF). This document does not constitute a solicitation or invitation to subscribe or make an offer to purchase any securities, nor does it form the basis of any contract or obligation of any kind. The sole binding basis for the acquisition of Swisscanto Funds are the respective legal documents (management regulations, sales prospectuses and key information documents (PRIIP KID), as well as financial reports), which can be obtained free of charge at https://products.swisscanto.com as well as at Swisscanto Fondsleitung AG, Bahnhofstrasse 9, CH-8001 Zurich (also acting as representative of the Luxembourg Swisscanto funds in Switzerland) or in all offices of Zürcher Kantonalbank. Paying Agent for the Luxembourg Swisscanto funds in Switzerland is Zürcher Kantonalbank, Bahnhofstrasse 9, CH-8001 Zurich. Information about the sustainability-relevant aspects in accordance with the Regulation (EU) 2019/2088 as well as Swisscanto's strategy for the promotion of sustainability and the pursuit of sustainability goals in the fund investment process are available on the same website. The sub-fund referred to in the document is subject to Article 9 of Regulation (EU) 2019/2088. The distribution of the fund may be suspended at any time. Investors will be informed about the deregistration in due time. The investment involves risks, in particular those of fluctuations in value and earnings. Investments in foreign currencies are subject to exchange rate fluctuations. Past performance is neither an indicator nor a guarantee of future success. The risks are described in the sales prospectus and in the PRIIP KID. The information contained in this document has been compiled with the greatest care. Despite professional procedures, the correctness, completeness and topicality of the information cannot be guaranteed. Any liability for investments based on this document will be rejected. The document does not release the recipient from his or her own judgment. In particular, the recipient is recommended to check the information for compatibility with his or her personal circumstances as well as for legal, tax and other consequences, if necessary, with the help of an advisor. The prospectus and PRIIP KID should be read before making any final investment decision. The products and services described in this document are not available to U.S. persons under the relevant regulations (in particular Regulation S under the U.S. Securities Act of 1933).

Data as at (where not stated otherwise): 11.2024

© Zürcher Kantonalbank. All rights reserved.

This document only serves advertising and information purposes and is not directed at persons in whose nationality or place of residence prohibit access to such information under applicable law. Where not indicated otherwise, the information concerns the collective investment schemes under the law of Luxembourg managed by Swisscanto Asset Management International S.A. (hereinafter "Swisscanto Funds"). The products described are undertakings for collective investment in transferable securities (UCITS) within the meaning of EU Directive 2009/65/EC, which is governed by Luxembourg law and subject to the supervision of the Luxembourg supervisory authority (CSSF).

This document does not constitute a solicitation or invitation to subscribe or make an offer to purchase any securities, nor does it form the basis of any contract or obligation of any kind. The sole binding basis for the acquisition of Swisscanto Funds are the respective published legal documents (management regulations, sales prospectuses and key information documents (PRIIP KID), as well as financial reports), which can be obtained free of charge at https://products.swisscanto.com/. Information about the sustainability-relevant aspects in accordance with the Regulation (EU) 2019/2088 as well as Swisscanto's strategy for the promotion of sustainability and the pursuit of sustainability goals in the fund investment process are available on the same website. The sub-fund referred to in the document is subject to Article 9 of Regulation (EU) 2019/2088.

The distribution of the fund may be suspended at any time. Investors will be informed about the deregistration in due time. The investment involves risks, in particular those of fluctuations in value and earnings. Investments in foreign currencies are subject to exchange rate fluctuations. Past performance is neither an indicator nor a guarantee of future success. The risks are described in the sales prospectus and in the PRIIP KID. The information contained in this document has been compiled with the greatest care. Despite professional procedures, the correctness, completeness and topicality of the information cannot be guaranteed. Any liability for investments based on this document will be rejected. The document does not release the recipient from his or her own judgment. In particular, the recipient is recommended to check the information for compatibility with his or her personal circumstances as well as for legal, tax and other consequences, if necessary, with the help of an advisor. The prospectus and PRIIP KID should be read before making any final investment decision.

An overview of investors' rights is available at https://www.swisscanto.com/int/en/legal/summary-of-investor-rights.html.

The products and services described in this document are not available to U.S. persons under the relevant regulations (in particular Regulation S under the U.S. Securities Act of 1933). Data as at (where not stated otherwise): 11.2024

© Zürcher Kantonalbank. All rights reserved.