From Rust to Riches: Salvaged Cars Driving the Circular Economy

The salvaged cars industry is one of the most promising drivers of the circular economy. Which is why investors should also be interested in scrap.

Three key points on the importance of the end-of-life vehicle industry for the circular economy

- Companies in the end-of-life vehicle industry have moved far beyond scrap yards and formed a highly efficient ecosystem. The United States is playing a pioneering role in this development.

- Specialized auction houses act as a link between sellers and buyers in the US. Investors should pay particular attention to these platforms.

- The trend toward electromobility and autonomous driving presents both opportunities and risks for the used car industry.

When you think of recycling, a PET plastic bottle is probably the first thing that springs to mind. However, the opportunities presented by the paradigm shift towards a circular economy go far beyond this prime example. From an investor's perspective the recycling of vehicles and their parts comes to mind.

Singing the praises of salvaged cars is not just talk: The industry is already considered by market experts to be extremely lucrative. The United States is playing a pioneering role here. Various sectors there have long been working hand in hand in the recycling of vehicles, while a few companies have even achieved a dominant position in their respective market sectors.

Huge volumes

Huge volumes are involved. According to an analysis by the Royal Bank of Scotland (RBC), around 12 million vehicles are taken off the road in the ‘car nation’ USA every year - or end up in the scrap yard due to accident. And the trend is pointing upwards: RBC estimates that the number of end-of-life vehicles there increased by around 5% annually between 2013 and 2020. The drivers of this development are the growing vehicle fleet, the increase in mileage, but also the fact that the cost of repairs has risen with the increasing use of expensive technology in cars.

This is when the end-of-life vehicle industry comes into its own, after suppliers, car manufacturers and repair companies have already made money from the vehicles. The companies in this field have long since left the traditional scrap yard far behind and have instead formed a highly efficient ecosystem.

Tinder for ‘rust buckets’

This is how car insurers decide whether a vehicle can still be repaired and be fit for driving on US roads. If the decision is in favour, repairs are mostly done by independent garages, while spare parts are often supplied by large, listed companies such as O'Reilly, Advance Auto Parts or AutoZone. However, if the insurers give the thumbs down, companies that specialise in dismantling, restoring or selling scrap metal come into play.

In the USA, specialised auction houses act as a link between sellers and buyers. They organise the temporary storage of the cars and provide digital marketplaces on which the scrap cars are advertised - a kind of Tinder for ‘rust buckets.

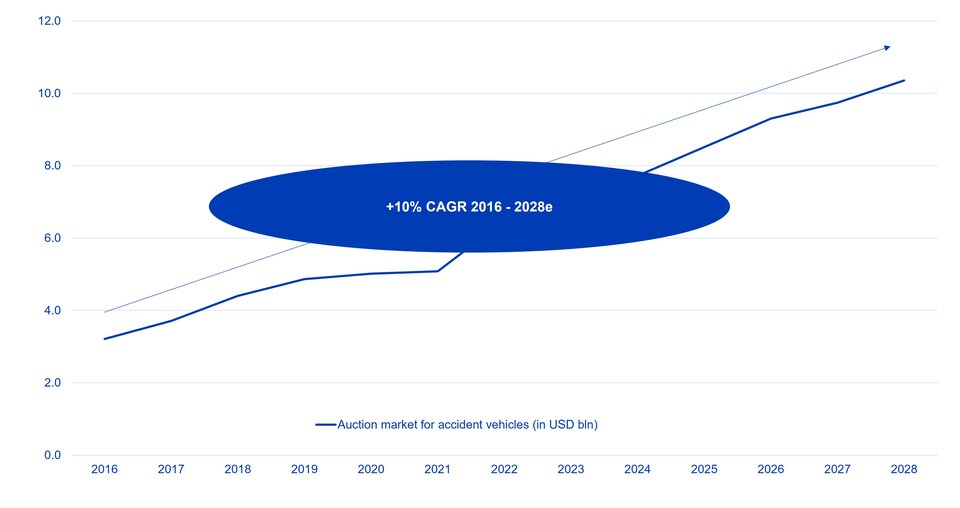

In the States, the provider Copart and the company IAA, which was acquired by Ritchie Bros. Auctioneers (RBA) in 2023, account for almost all of the business for which a double-digit growth in turnover has been forecast ed for the period from 2016 to 2028 (see table below). Following the takeover, we believe RBA is a promising challenger to Copart. The new management is placing great emphasis on improving both the service and the prices at which customers can sell their cars. This focus has proven successful and market share has been regained; RBA is now our preferred auction house.

Potential buyers from outside the U.S.

These auction houses are increasingly bringing in new potential buyers from outside the U.S., where repair costs are lower. This benefits insurance companies, who can sell the cars at a higher price, as well as the environment, as it extends the lifespan of the vehicles. Also, the segment is a good example of circular economy benefiting from the new U.S. policies. Introduction of tariffs on passenger vehicles lead to higher average car prices and spare parts, which benefits the resell platforms, as fees are based on price.

All considered, the segment fits into the SPQ framework (Sustainable Purpose Quality) used by Swisscanto for thematic investments: significant growth potential thanks to sustainable solutions, combined with the prospect of potentially high returns on invested capital (ROIC) due to high barriers to entry and relatively limited competition in the niche market.

Auction market for vehicles declared a total loss (sales in USD billions)

Electric vehicles of value

For investors interested in the opportunities offered by the circular economy, the trend towards electromobility (see box below) also seems interesting. It is true that electric vehicles (EV) are still a new frontier for the salvaged cars industry: the technology is simply too new to be found en masse in scrap yards. Nevertheless, it is estimated that by 2035 an estimated 10 million electric vehicles will have reached the end of their service life.

But experts like those at RBC believe that this could turn out to be positive for the auction houses. Because of their many electronic components, electric cars are more difficult to repair. Insurers may be more inclined to send them to the scrap yard - which is not ideal from a sustainability perspective. However, given the relatively simple assembly of EVs and the fact that some parts may be of high value, new business models are likely to emerge, such as 'specialised EV dismantlers', which would facilitate links between insurers and battery and electronics recyclers, for example.

Circular economy crucial for resource independence

The recent agreement between the US and China on rare earths shows that access to resources is of geopolitical significance, especially in view of the trend toward electromobility. Without lithium and nickel, there would be no batteries for electric cars, and without rare earths, there would be no electric motors. The circular economy can help keep resources in the system and secure economic independence: According to estimates, 40% of new electric car batteries could come from recycled materials by 2040. It is no coincidence that governments are taking measures to promote the circular economy, while companies are increasingly adopting circular processes. Investors can position themselves accordingly.

Stable number of collisions

The widespread use of advanced driver assistance systems (ADAS) to help drivers avoid collisions is also a dream of the future. Statistics from the National Highway Traffic Administration in the US, for example, show that the frequency of collisions has almost halved since the 1980s. However, the number of reported collisions has remained more or less stable at around 6.2 million over the past 30 years. This is due to the increase in traffic. Since 2012, the number of collisions has actually been on the rise - this could be due to the distraction caused by smartphones while driving.

It is conceivable that vehicles equipped with ADAS throughout could communicate with each other and reduce the collision rates to almost zero. However, this technology would probably also make repairs more expensive. Which, in turn, suggests that there will still be work for scrap specialists in the future. Similarly, the rapid development of robotaxis could threaten the salvage car industry, although it remains to be seen whether collision rates would indeed fall.

Essential expertise

Like digitalisation, the transition to a circular economy is an investment theme that promises above-average returns for long-term investors. More and more companies are likely to decide to invest in the circular economy, driven in part by changes in consumer behaviour and new regulations. Market research company Gartner, for example, assumes that around 60% of global companies will achieve profitable growth through circular supply chains by 2026.

However, as the investment theme is highly complex and influenced by both regulation and consumer behaviour, specific expertise and a focus on quality companies are essential. Accordingly, funds actively managed by experts can offer significant added value. The Asset Management of Zürcher Kantonalbank has many years of in-depth expertise in sustainable thematic investing and sports a dedicated investment strategy for the "circular economy" investment theme.

Investment theme «Circular Economy»: Insights

Legal disclaimer Switzerland and international

Legal disclaimer Switzerland and international

Legal information regarding the chart: Customer acknowledges that the Index is provided "as is " with all faults all warranties and representations of and kind with regard to the Index are disclaimed including any implied warranties of merchantability, quality, accuracy, fitness for a particular purpose and/or against infringement and/or warranties as to any results to be obtained by and/or from the use of the index, there are no representations or warranties which extend beyond the description on the face of this agreement, if any, J.P. Morgan does not guarantee the availability, sequence, timeliness, accuracy or completeness of the Index, J.P. Morgan may discontinue generating the Index at any time without prior notice and, to the fullest extent permitted by applicable law, J.P: Morgan will not be liable (in contract, tort or otherwise) For any ordinary, direct, indirect, consequential, special, punitive or exemplary damages in connection with this agreement and/or any use of the Index even if J.P: Morgan has been apprised of the likelihood of such damages occurring.

This document only serves advertising and information purposes, is for distribution in Switzerland only and is not directed at persons in whose nationality or place of residence prohibit access to such information under applicable law. Where not indicated otherwise, the information concerns the collective investment schemes under the law of Luxembourg managed by Swisscanto Asset Management International S.A. (hereinafter "Swisscanto Funds"). The products described are undertakings for collective investment in transferable securities (UCITS) within the meaning of EU Directive 2009/65/EC, which is governed by Luxembourg law and subject to the supervision of the Luxembourg supervisory authority (CSSF). This document does not constitute a solicitation or invitation to subscribe or make an offer to purchase any securities, nor does it form the basis of any contract or obligation of any kind. The sole binding basis for the acquisition of Swisscanto Funds are the respective legal documents (management regulations, sales prospectuses and key information documents (PRIIP KID), as well as financial reports), which can be obtained free of charge at https://products.swisscanto.com as well as at Swisscanto Fondsleitung AG, Bahnhofstrasse 9, CH-8001 Zurich (also acting as representative of the Luxembourg Swisscanto funds in Switzerland) or in all offices of Zürcher Kantonalbank. Paying Agent for the Luxembourg Swisscanto funds in Switzerland is Zürcher Kantonalbank, Bahnhofstrasse 9, CH-8001 Zurich. Information about the sustainability-relevant aspects in accordance with the Regulation (EU) 2019/2088 as well as Swisscanto's strategy for the promotion of sustainability and the pursuit of sustainability goals in the fund investment process are available on the same website. The sub-fund referred to in the document is subject to Article 9 of Regulation (EU) 2019/2088. The distribution of the fund may be suspended at any time. Investors will be informed about the deregistration in due time. The investment involves risks, in particular those of fluctuations in value and earnings. Investments in foreign currencies are subject to exchange rate fluctuations. Past performance is neither an indicator nor a guarantee of future success. The risks are described in the sales prospectus and in the PRIIP KID. The information contained in this document has been compiled with the greatest care. Despite professional procedures, the correctness, completeness and topicality of the information cannot be guaranteed. Any liability for investments based on this document will be rejected. The document does not release the recipient from his or her own judgment. In particular, the recipient is recommended to check the information for compatibility with his or her personal circumstances as well as for legal, tax and other consequences, if necessary, with the help of an advisor. The prospectus and PRIIP KID should be read before making any final investment decision. The products and services described in this document are not available to U.S. persons under the relevant regulations (in particular Regulation S under the U.S. Securities Act of 1933).

Data as at (where not stated otherwise): 11.2024

© Zürcher Kantonalbank. All rights reserved.

This document only serves advertising and information purposes and is not directed at persons in whose nationality or place of residence prohibit access to such information under applicable law. Where not indicated otherwise, the information concerns the collective investment schemes under the law of Luxembourg managed by Swisscanto Asset Management International S.A. (hereinafter "Swisscanto Funds"). The products described are undertakings for collective investment in transferable securities (UCITS) within the meaning of EU Directive 2009/65/EC, which is governed by Luxembourg law and subject to the supervision of the Luxembourg supervisory authority (CSSF).

This document does not constitute a solicitation or invitation to subscribe or make an offer to purchase any securities, nor does it form the basis of any contract or obligation of any kind. The sole binding basis for the acquisition of Swisscanto Funds are the respective published legal documents (management regulations, sales prospectuses and key information documents (PRIIP KID), as well as financial reports), which can be obtained free of charge at https://products.swisscanto.com/. Information about the sustainability-relevant aspects in accordance with the Regulation (EU) 2019/2088 as well as Swisscanto's strategy for the promotion of sustainability and the pursuit of sustainability goals in the fund investment process are available on the same website. The sub-fund referred to in the document is subject to Article 9 of Regulation (EU) 2019/2088.

The distribution of the fund may be suspended at any time. Investors will be informed about the deregistration in due time. The investment involves risks, in particular those of fluctuations in value and earnings. Investments in foreign currencies are subject to exchange rate fluctuations. Past performance is neither an indicator nor a guarantee of future success. The risks are described in the sales prospectus and in the PRIIP KID. The information contained in this document has been compiled with the greatest care. Despite professional procedures, the correctness, completeness and topicality of the information cannot be guaranteed. Any liability for investments based on this document will be rejected. The document does not release the recipient from his or her own judgment. In particular, the recipient is recommended to check the information for compatibility with his or her personal circumstances as well as for legal, tax and other consequences, if necessary, with the help of an advisor. The prospectus and PRIIP KID should be read before making any final investment decision.

An overview of investors' rights is available at https://www.swisscanto.com/int/en/legal/summary-of-investor-rights.html.

The products and services described in this document are not available to U.S. persons under the relevant regulations (in particular Regulation S under the U.S. Securities Act of 1933). Data as at (where not stated otherwise): 11.2024

© Zürcher Kantonalbank. All rights reserved.